Welcome (back) to our Six Stones series. Our financial adviser, Jordan, is sharing as many tips, ideas and advice for people going through a divorce as a humble blog will allow. He’s staying away from specific financial advice – it’s all general advice over here, be sure to get personal financial advice before doing anything – but we hope you find some useful information in here as you navigate through/out of your divorce.

So.

What does this all mean for you as you try to work out if you should use insurance to manage some of your risks?

There is no easy answer, but let’s return to Louise to explore some of the things she might consider in making her own insurance decisions.

Now, before we start, two notes:

– I’m going to use some of the tools we use when preparing personal financial advice for our Bespoke clients. Not all of it, but enough that there is a risk of going into too much detail. If you’re looking for that kind of detail to help in your own decisions, fantastic. But if you’re not, you can skip this section without any issues.

– None of this should be seen as personal advice for you. I don’t know anything about your situation so there’s obviously no way I can take your circumstances into account when writing this.

Instead, this is a fictional scenario to show you some of the things a professional adviser takes into account when providing advice around insurance. I’ve based it on real quotes from an unnamed insurer, but this should not be seen as ‘true’.

If this is something you’d like to explore, then don’t take any of the actions I’m outlining here – speak to a financial adviser and have them advise you.

OK – disclaimers over. Let’s get into it!

What Louise Needs

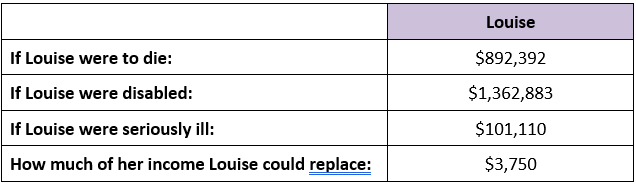

As I’ve said ad nauseum by now, Louise is carrying a level of exposure to the financial risks of death, disability or serious illness. We’ve already worked out how big this exposure is:

We’ve also talked about the steps Louise could take to minimise this exposure – to Close the Gap – but in this case, Louise has decided not to do anything about that.

The next step is to work out just how much it will cost Louise to use insurance to Transfer this exposure to somebody else.

The Quotes

What this involves is collecting a bunch of quotes from the different insurers in Australia to work out what they’re going to charge for this level of cover.

We advisers can do this direct with the insurer, or via dedicated comparison software.

But you can do it too – there are plenty of comparison sites online that will help you arrange quotes for your own personal exposure.

Now, I don’t really like using them – I don’t like the ‘gatekeeper’ method they use where you ask for quotes and then your phone gets bombarded with cold calls from some call centre – but they can do this for you. Just be aware that the information you can get from these resources is inevitably limited.

Anyway.

It’s time to start preparing the quotes. But first, some questions.

The Questions

In the previous chapters, we explored some of the characteristics of the four main types of life insurance in Australia. I tried to walk that tightrope between too little and too much detail, which has meant that I had to leave some things out.

But, there are enough variables to start a handy list of questions for you to answer as you arrange your own quotes:

1. Stepped or Level premiums?

2. Linked or not linked?

3. Owned in super, or not?

4. Monthly or annual premiums?

5. For income protection – what waiting period and benefit period would you like?

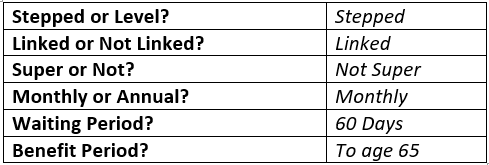

I’ll avoid returning to a detailed discussion of all these questions, so let’s just say Louise has made the following choices initially:

Stepped or Level: Not Sure

Linked or Not Linked: Linked

Super or Not: Not

Monthly or Annual: Monthly

Waiting Period: 60 days

Benefit Period: To Age 65

This lets us get started on the quotes.

Stepped or Level?

Because Louise isn’t sure about whether Stepped or Level premiums are best for her, we’ll prepare two sets of quotes.

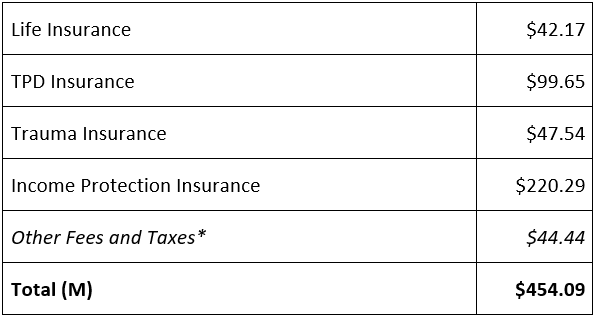

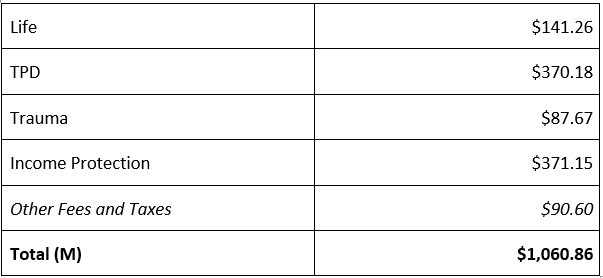

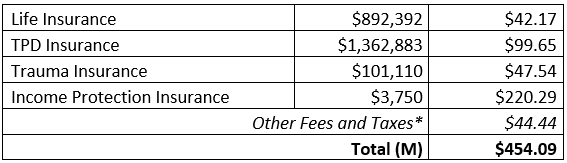

To cover Louise’s full risk exposure using Stepped premiums, she’d be looking at the following premiums:

This, and all quotes, have been taken directly from a major Australian insurer’s quoting system Monday, 17th August 2020.

*Most insurers charge an annual policy fee (please don’t ask me why – I have no idea!) and in some states, the government takes a cut for Stamp Duty too.

Which means that, on an annual basis, the full amount of insurance for Louise would cost $5,449 – or 9.08% of her gross income of $60,000 a year.

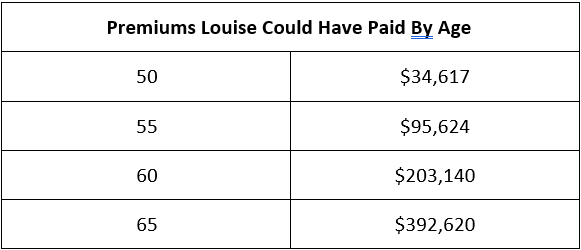

That’s in the first year though – so knowing that Stepped Premiums increase each year, we will also try to project out what that premium might become into the future.

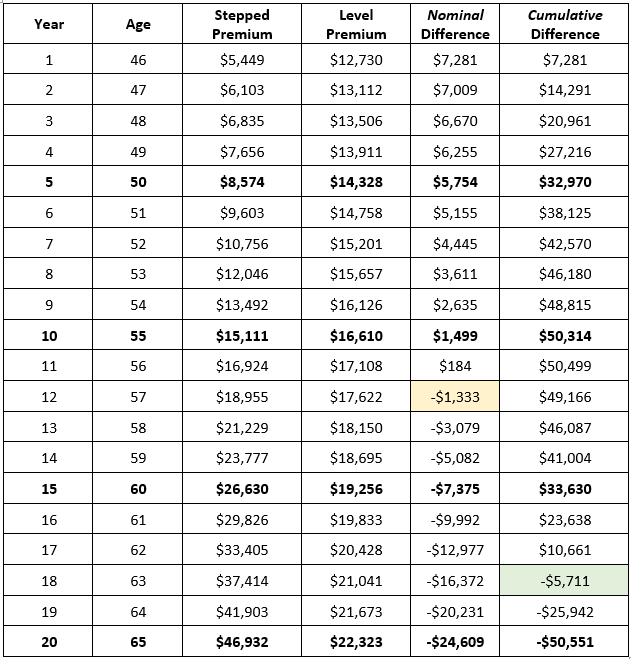

If we (conservatively) assume that the premium will go up by 12% a year, then here’s how that plays out for Louise:

Assumes a 12% steady rate of increase each year on the premiums and no change to the benefit amount through to age 65.

These are big numbers, but don’t forget that final figure is the total Louise would pay over 19 years.

Is This ‘Affordable’?

Still a hefty number though – how affordable is it?

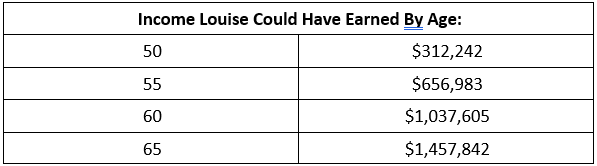

Well, let’s project out Louise’s income over the same timeline and see how much of it this premium would chew up:

*Assumes a 2% annual increase to Louise’s salary, and that she maintains her current job and number of hours through to age 65. This is her pre-tax earnings.

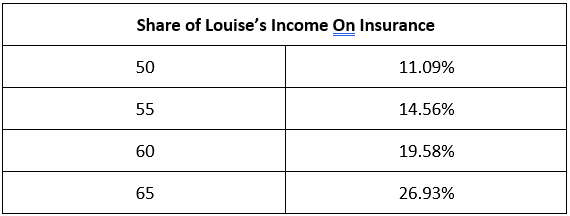

And, as a percentage:

Now we have some context to the picture:

– If Louise were to use insurance to Transfer the full Gap she’s exposed to, it would cost her $454 per month on a Stepped premium.

– If she then kept that cover all the way to 65, though, she would end up spending over 26% of her entire gross (pre-tax) earnings on insurance.

o This sounds terrible – because it is – but it’s unlikely that Louise would need this same level of cover the whole time.

o Often, people can reduce their amount of cover over time as their Gap closes. Not always, but this can help offset some of these costs.

o Still – 26% is a huge portion of her earnings!

– The biggest part of the insurance premium is her Income Protection policy.

o The good news about that is Income Protection has the most pricing flexibility, which we’ll come back to shortly.

Level Premiums

That’s Stepped Premiums though, they start cheaper and climb – steeply – over time to eventually become super-expensive.

What about the other option, Level Premiums?

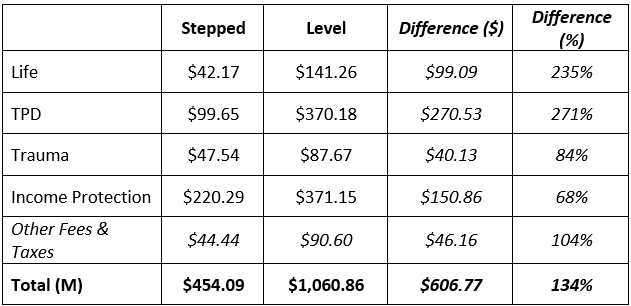

Well, using Level Premiums makes a serious difference to the monthly premiums in the first year (you’ve been warned!):

This works out to $12,730 for the first year, or 21.22% of Louise’s gross income. This is an eye-watering 134% higher than the Stepped Premium option in the first year:

But Level Premiums can be a better long-term option, theoretically, as the annual rate of increase is generally far, far lower than with Stepped Premiums.

Because of this mathematical reality, eventually two things happen when comparing these options:

1) The nominal, or annual, Level Premium becomes lower than the nominal Stepped Premium;

2) The cumulative, or total spent in the time you’ve had the policy, Level Premium drops below the cumulative Stepped Premium.

What this means for you, though, is answering another pair of questions:

– How long is ‘eventually’?

– Is it too long?

In other words – if you’re only going to need insurance for 15 years, then waiting 17 years for the cumulative Level Premium to drop below the cumulative Stepped Premium doesn’t make a lot of sense.

What’s this mean for Louise? Well:

What does all this actually mean?

– If Louise held these policies for five years, she’d pay an extra $32,970 all up for Level Premiums.

– After ten years, this would be $50,314 in total.

– It takes until the 12th year for the nominal Stepped Premium to be higher than it’s Level Premium equivalent.

– It’s not until Louise turns 63 that the cumulative Level premium goes below the Stepped version.

Given these differences and taking into account Louise’s situation, it is hard to justify recommending Level Premiums for her insurance portfolio.

(Again, this is a general note – your circumstances will be different and Level Premiums might be better for you. The only way to tell is to go through this exercise yourself).

Louise’s Decision

Because of this, we can update Louise’s table of answers:

Which means that Louise would look to apply for this level of cover, at these quoted premiums:

What If…?

Now we have a real starting point for Louise to work from. It’s entirely possible Louise may think $454 a month is more than she’d like to spend on insurances.

And there are a few ways she can bring this down to something more manageable:

– Louise might choose to decrease the level of exposure she wants to Transfer across the board.

– She might consider extending her Income Protection waiting period out to 90 days.

– As we mentioned in the Closing the Gap chapter, Louise might look to remove some of the extra amounts she wants to provide her family to bring the price down.

– Louise could move part of her insurance premium into her super fund. It doesn’t make it cheaper, but it takes it away from her personal cashflow and means her super pays for it. (This is a complex choice – I really encourage getting financial advice before deciding on this one).

And there are plenty of other ways Louise can reduce this expense. The important thing is that she’s starting from an informed and detailed position.

Honestly – the hard works already been done; now it’s just a matter of tweaking to find a solution Louise is happy with.

There is one big way Louise can reduce her premiums that we haven’t covered yet. Let’s turn to the complicated topic of insurance commissions in our next chapter.