Welcome (back) to our Six Stones series. Our financial adviser, Jordan, is sharing as many tips, ideas and advice for people going through a divorce as a humble blog will allow. He’s staying away from specific financial advice – it’s all general advice over here, be sure to get personal financial advice before doing anything – but we hope you find some useful information in here as you navigate through/out of your divorce.

My last post outlined the two factors that go into assessing a risk, namely – the likelihood of an event occurring and the impact of it happening.

Once you’re familiar with these two aspects of a risk, it really helps you with classifying the different risks we all face every day.

Why bother doing that? Two reasons:

1) It helps you identify the ones worth worrying about and the ones you can not spend mental currency on;

2) It dilutes the fear we have about the risks we face because you’re taking back control over elements of your life.

The Framework[1]

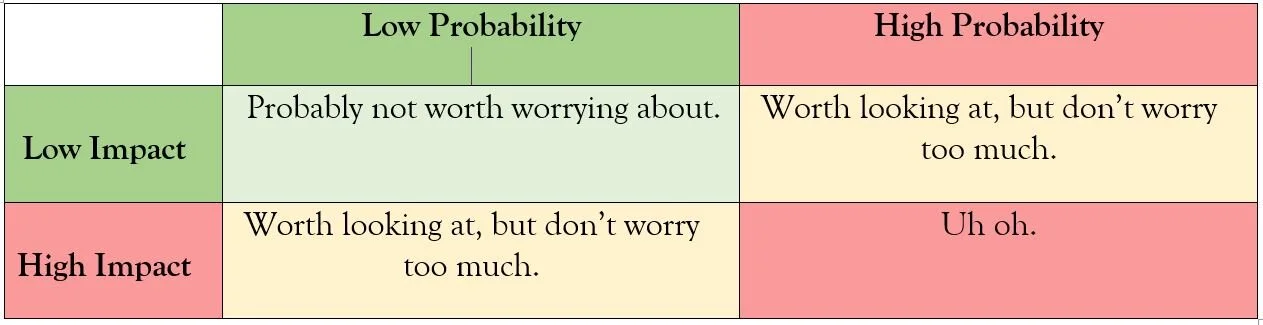

All of which translates tidily into an easy matrix to help us put some structure around looking at these pesky risks, which makes it a lot easier to see which ones you should worry about.

Here’s the table for your reference:

We want to avoid the Uh Ohs.

As you can see, it breaks down into four different categories:

1) Low Probability / Low Impact

Think of things like missing your train when you’re running early.

2) Low Probability / High Impact

A plane crash, or earthquake in Melbourne.

Or, despite the figures that are bandied about, the risk of getting divorced in any given year.

3) High Probability / Low Impact

The risk that your superannuation will fall in value in any 12-month period.

4) High Probability / High Impact

The high-priority zone. Things as bad as a cancer diagnosis[2] or those Takata airbags going off unexpectedly[3].

I’ll revisit this idea later, but I suggest thinking of a few risks you’re currently exposed to and trying to allocate them into one of these squares.

Coming out of a divorce, there are a few common ones:

-

The kids struggling with the emotional toll of the separation (high probability / high impact)

-

Not being able to find a job (low probability /high impact)

-

Having people gossip about you (high probability / low impact)

-

Making a minor mistake with your finances (high probability / low impact)

-

Receiving bad financial advice about your property settlement (low probability (I hope) / high impact)

But you’ll have your own individual ones – take a few moments now to scribble a table on that piece of paper nearby and slot the risks in.

They’re Sorted – Now What?

Now we have a framework we can use when looking at risks – which helps us work out which ones to worry about now, later or never.

The next step is to work out what we want to do about these risks.

There are, essentially, five options when it comes to dealing with any risks:

1) Accept

Just accept that this risk might happen and accept that you’ll deal with if/when it does.

2) Avoid

Simply avoid the risk completely. To use the Takata recall in the previous section – if your car was affected by the recall, you could avoid the risk by taking it in to have the airbag replaced.

3) Transfer

Pass the consequences of the risk occurring to somebody else. Car insurance is a prime example – you’re transferring the financial cost of the risk (a car accident) to the insurer so that you won’t have to cop the impact if it should occur.

4) Mitigate

Put another way – try to reduce the risk of something occurring and/or the impact it will have.

Consider the risk of having a heart attack. A regimen of healthy eating and exercise will reduce the chance of you having a heart attack, decreasing the likelihood of it happening.

And then, if you do have one, the same regimen should also have mitigated the impact – hopefully reducing the severity and term, thus mitigating the overall risk.

5) Exploit

More common in business, there are some risks that you can exploit to your advantage. What they are and whether it’s something you’d look to do are beyond the scope of this particular guide.

My next post will take what we’ve covered so far and wrap it up into a straightforward plan for you to look at your risks.

A plan to manage your risks, if you will. I’ve used a very creative name for it too.

[1] This isn’t a new concept – a quick Google search will bring up any range of versions of this matrix.

[2] https://www.cancer.org.au/about-cancer/what-is-cancer/facts-and-figures.html , <Accessed 31 October 2019>

[3] https://www.ismyairbagsafe.com.au/ , <Accessed 31 October 2019>