Welcome (back) to our Six Stones series. Our financial adviser, Jordan, is sharing as many tips, ideas and advice for people going through a divorce as a humble blog will allow.

He’s staying away from specific financial advice – it’s all general advice over here, be sure to get personal financial advice before doing anything – but we hope you find some useful information in here as you navigate through/out of your divorce.

In an earlier post, I wrote about the ‘Nightmare Conversation’ – where a doctor sits you or your loved ones down and tells you that the results were not what they were hoping for.

That conversation shifts the direction of your life; it shunts you onto a different track.

And the last thing I want for the people to work with is to have to think to themselves “I can’t afford to be sick”.

That’s where Trauma insurance comes in.

What Is It

Trauma, or ‘Critical Illness’, insurance, pays a benefit when you’re diagnosed with a serious illness that’s included in the policy.

It’s paid as a lump sum and it’s the diagnosis that matters. This makes it different to TPD insurance, where it’s your ability to do your job that matters.

There are stories of people having a heart attack and returning to work in three months – while receiving a full payment on their trauma policy – the payout is not linked to their ability to work.

How Much Do You Need?

Let me crank up the broken record on this one again – but you need enough to cover The Gap!

Depending on your priorities, this Gap will vary massively with each person. Some people might want to clear the entire mortgage if they get cancer; somebody else might want to just cover the repayments.

One person might wish to allow for any possible treatment possibility; another might choose to rely on the public system but provide for a buffer to help out with the additional costs.

However you choose to construct the Gap, there are a few things to be aware of:

1. The Journey of the Illness

The journey of an acute illness is quite different to a permanent, or chronic one. To grossly simplify:

-

you’re sick

-

you’re diagnosed

-

you’re treated and

-

you either recover, or you don’t.

And your life is on ‘Pause’ as you address this view-sharpening priority.

In many cases, this journey can be less than two years long. After that – in the best of cases – a fully recovered patient returns to their life and presses ‘Play’.

The financial needs tend to reflect this journey. They will be worst during the worst of this personal crisis, but should tail off as you move into the recovery phase.

Of course, this isn’t always the case, but if we look at it from a crassly binary viewpoint – if you get better, you’ll return to work and be able to regain your former financial trajectory.

And if you don’t, your other insurances could kick in and take over the financial burden.

Either way, you may not need to make huge provisions for long-term commitments with your trauma insurance because most trauma cases will move into one of these alternatives eventually.

This is, of course, horribly simplified and each situation is strikingly different. However, I do encourage you to keep this journey in mind when working out your own priorities.

2. The Likelihood of a Claim

Here’s a strange one for you – have you known more people that have had cancer, been disabled or passed away?

For most people, they know more people that have had cancer.

I ask this because it highlights the statistically-high likelihood of somebody claiming on their trauma insurance policy.

We have a tendency to seriously downplay the likelihood of awful things happening to us – but I ask you to try and put that reflex aside and plan your Gap as if you will have to claim on this cover.

Because, sadly, you just might.

3. A Blank Cheque

Maddeningly, there is no agreed-upon formula for how much Trauma Insurance you should have. If it were as simple as (A + B + C) – D, then it’d be much easier to help people on this.

But let’s say ‘B’ is ‘medical costs’ – how much should you allocate to that?

Is it the $5,000 out-of-pocket cost most Australian’s that have had cancer experience?

Or the mooted $500,000 cost for CAR T Cell cancer treatments[1]?

I should say, I don’t have an answer for this. This will be different for each person and will come down to your own assessment of what you need, want and can afford.

Because each extra dollar covered will increase the premium. So it’s not really viable to take out a ‘blank cheque’ level of cover – this decision will involve some level of compromise.

When It Pays

In some ways, Trauma is a ‘simpler’ insurance policy, in that the definitions are in black-and-white.

If your diagnosis meets the very specific conditions of the definition, the insurer will pay. If it doesn’t, then they don’t.

This gives it the advantage of – generally – resolving the claims quite quickly. But it also means that events that can feel life-changing for you, like a ‘mild’ heart attack (which always strikes me as an absurd idea), won’t necessarily trigger a payment.

Better luck with your next heart attack, I suppose.

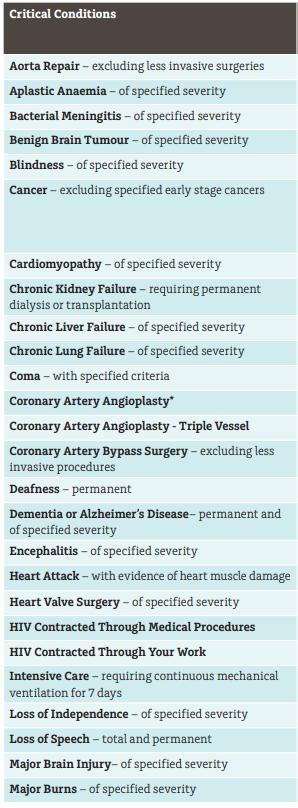

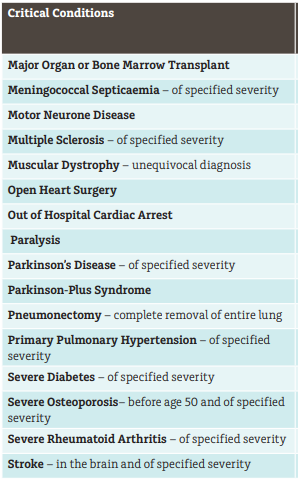

I’ve snipped the following images from a major insurer’s Product Disclosure Statement (I’ve excluded the actual company because I don’t want to seem like I’m recommending them – the rules we work under are very strange…).

As you can see, it’s a litany of human tragedy:

This is just the list of conditions covered by this policy, mind you. I’ll get into the definitions in a second, but I’d suggest taking another look at that list.

None of these are desirable illnesses, and each of them will have a different impact on your life.

Some will be an acute illness that you will recover from and go on to live a full life. Some of them will hang around and cause permanent damage to your body.

Sadly, some of them will progress and end your time here on Earth.

Regardless, each of them will have some impact on your life – and on your finances.

The Definitions

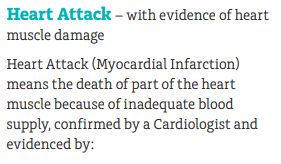

Now, each condition listed in that table will then have it’s own, alarmingly specific, definition. Insurers try to align these with the medical definitions, but for various reasons this can’t always be done.

Anyway, let’s look at the definition this insurer has for a ‘heart attack’:

If somebody’s heart attack satisfies these terms, then the claim will be paid. If it doesn’t – if your heart attack isn’t ‘serious’ enough – then it won’t.

I don’t want to stroll too much farther into the weeds here, but the point I want to make here is that the terms around these medical conditions are firm, clear and consistent.

This level of ‘certainty’ is really valuable in the event of a claim.

One final note here as well, actually:

When you’re comparing definitions between insurers (an activity at least as much fun as you’re currently imagining…), I suggest focusing on the ‘big 3’ conditions which account for the majority of claims – Cancer, Heart Attack and Stroke.

When Does It Not Pay

As I’ve suggested above, there are a few occasions where the policy won’t pay:

1) Doesn’t Meet the Definition

This is completely understandable of course – for instance, our car insurer doesn’t pay us the full value of our car when we scratch the paint.

But that intellectual appreciation of reality doesn’t make it any easier when you find out you’re not going to get paid because your cancer isn’t awful enough.

2) Self-Inflicted

It is safe to assume that any claim based on something you’ve done to yourself would be denied.

There are some timing factors here – like the suicide clause I’ve written about in the Life Insurance post – but personal responsibility for an illness or injury makes it quite unlikely you’ll be paid any benefit.

3) Within 90 Days

This is a deep cut, this one.

To avoid people finding a lump then taking out trauma insurance, insurers introduced a 90-day qualifying period for many conditions.

Meaning that if you are diagnosed with cancer, say, within 90 days of starting the policy, they won’t pay you a benefit.

However, if you’re moving from another insurer where you had similar cover, sometimes they’ll waive this.

We’re talking nitty-gritty details here, so I encourage you to get personal advice on your situation before making any changes like this.

4) Non-Disclosure

We’ve talked about this one a few times, so I’ll keep this one brief – if you lie on your application, the insurer will find out and they won’t pay the benefit.

Be honest, be upfront and you can avoid this awful outcome.

Some Things To Look Out For

When you start looking for Trauma Insurance for yourself, it’s incredibly easy to feel like you’re drowning in the details.

Before too long you find yourself comparing Clark Levels and Q-Wave requirements, or running increasingly absurd statistical exercises.

To help with this, here are a few areas I focus on when I’m considering policies:

1) The Big Three

As I’ve mentioned earlier, the big three conditions – cancer, heart attack and stroke – make up the bulk of claims on this type of policy.

As a result, I focus on the quality of these definitions. Are they clear? Are they broad? What’s excluded? What’s included? How does it compare to other providers out there?

The good news is that the insurers have congealed around certain definitions so there isn’t a lot of variance, but there are some. It’s worth finding them.

2) Partial Payments

I’ve also talked about events that aren’t ‘serious’ enough to trigger a payment. In some policies, these ‘minor’ conditions can still trigger a partial payment.

Sometimes up to 25%, these payments can nevertheless be a handy financial boost at a difficult time. They can mean an extra month off to rest and recuperate after treatment and, as such, are well worth looking for.

3) Breadth of Conditions

Simply put – how many conditions does the policy cover?

This type of quantification can be a blunt tool, and it can obscure some of the nuance you find in these contracts, but on the whole – more is normally better.

4) Cost

This is a big consideration. I’ve talked before that ‘cost’ should be one of the final filters you pass your insurance decision through.

Starting by limiting your decision by cost can mean avoiding making an informed decision about what you need.

However – trauma insurance is relatively expensive. It’s generally dearer than Life Insurance and TPD Insurance, and be on par with Income Protection cover.

This is for a few reasons – people are, sadly, quite likely to experience one of these conditions in their life and the amounts being paid out quickly add up. There are also none of the occupational factors mitigating the claims experience for the insurer to rely on.

There also aren’t enough people with this important coverage. If more people had it, the risk pool deepens and it becomes easier for insurers for keep prices down.

So, in my experience, Trauma Insurance is the one people compromise on the most. Once they’ve identified how much they need, this is the one they cut back the hardest to get to the amount they want.

I realise I haven’t addressed the importance of Trauma Insurance.

We’re fortunate in Australia that serious illness doesn’t necessarily bump us into poverty. But the ability to access a lump sum of money in the worst time of your life – to cover the bills, let you take time off work, pay for an experimental treatment – can transform your experience of an awful situation.

It provides you with options and some element of control. I believe it’s a critical part of a responsible person’s risk management plan and I encourage you to look into it as soon as you can.

[1] https://www.9news.com.au/national/60-minutes-new-blood-cancer-treatment-research-from-sydneys-westmead-institute/b211ce89-f9c8-4608-bff4-b0fdc683cb72