Worried that you’ll never be able to retire? That a ‘comfortable’ retirement is for other people, with ‘better’ finances, a clearer plan or more luck?

Well, you’re not alone. So, let me show you an example of how good financial advice with a clear plan can make a real difference to somebody’s financial future – and why you definitely don’t need $1 million to retire.

Meet Tracey

You might know Tracey already.

Tracey’s 64 years old and she’s avoided even thinking about retirement since her divorce 9 years ago. It wasn’t an especially messy divorce, but it doesn’t have to be messy to have a big impact.

One reason Tracey’s been reluctant to think about retiring is that her kids still lived with her until very recently. Her youngest – Lance – moved to interstate a few months ago with his partner.

It’s been a big change for him, but for Tracey it’s been momentous. Because, like most people that raised kids on their own, she’s always identified herself more as their Mum, than as ‘Tracey’.

Tracey has three kids – Louise, 34, who lives two suburbs over from Tracey with her husband and 5-year-old.

Leanne is 29, who’s had a harder time of things – she took the divorce pretty badly – but seems to have started settling down lately. Maybe it’s her new partner, maybe it’s just getting older, but Tracey says she doesn’t worry about Leanne quite as much now.

Lance is 26 and the third of Tracey’s kids.

Her Own Life

Tracey’s never been a ‘hobby’ person – she’s always been too busy with work or running the kids around to do anything for herself. Though as the kids moved out over the last few years, she has found herself going to the movies more regularly, which she loves – especially the classic runs that come up occasionally.

Tracey’s not keen on travelling anytime soon, especially not internationally. She’d like to be able to get up to Queensland during Melbourne’s winter, if she could, or get up to Sydney to see Lance every now and then.

But another reason Tracey has avoided thinking about retirement is the nagging question of how she’d spend the days.

She’s always worked – so what if she got bored when that stops?

What if she hates it?

As for a partner, Tracey’s met a few men since her divorce, men that she liked but nobody she ever felt ready to really commit to. The doors not closed, but she’s at ease with the possibility she won’t find another serious partner.

Working Life

Tracey’s been working part-time for the same lawyer for 20 years now.

Officially, she’s the Office Manager, but unofficially that really means that she does everything – reception, scheduling, events, client conversations, anything that keeps the office running.

Over time, her pay has grown to around $68,000 a year which – after taxes and everything else – leaves her with just under $1,000 per week in her pocket. She doesn’t keep a budget but tends to save around $3,000-5,000 a year.

Tracey enjoys her work – she likes the people she works with, she’s good at the job and it’s got enough variety to keep her interested.

But she has noticed that she’s more tired when she gets home now, a little less patient with the same problems she’s been juggling for years.

She’s put it down to Melbourne winter’s the last few years – leaving and returning in the dark every day takes it out of anyone – but it’s becoming more of a dull sound every day she has to go to work now.

Tracey occasionally thinks about retiring, but then she thinks about her financial situation, shudders, and pushes it to the back of her mind.

The Money Side

Which brings us to the financial side of things – the part that leaves most people so cold on retirement.

Tracey feels like she has a fair bit of super but is “pretty sure that it’ll never be enough” for her to retire.

She feels like she “kind of gets super” but is confused about all the specifics. This confusion makes her scared to make any changes because what if she stuffs something up?

She’s been putting an extra $100 a week into her super for the last few years after one of the lawyers nagged her to read the Barefoot Investor.

Thanks to that, plus working for the last 20 years, and averaging 6% a year on the funds – and the super split out of the divorce – her current balance is around $440,000.

There’s $20,000 in her savings account, which moves around a fair bit. One month she helped Lance replace his washing machine; the other she was able to put $1,000 back in there.

Then there’s the house.

Her and her ex bought their place 30 years ago, around the time Tracey was pregnant with Leanne. It’s served them well, so Tracey was happy to keep it in the divorce – even if doing so meant taking on a bigger mortgage than she was comfortable with at the time.

She thinks the house is probably worth at least $1.2 million now, and after nearly a decade of repayments, she’s got the mortgage under $230,000. She feels now that it’s too big for just her.

She’s sick of the yard, especially now that Lance isn’t around to mow it anymore, and cleaning the place is a headache.

In terms of assets, that’s all Tracey has though, besides her 12-year-old Mazda.

Another asset Tracey hasn’t really thought are her leave entitlements at work. She tends to use around half of her annual leave every year. Tracey also took 6 weeks of her long service leave during the divorce, so she could take care of the kids.

Between this and other accumulated benefits, Tracey estimates her final payout will be around $9,500.

What Worry’s Tracey

This leaves Tracey a little conflicted.

On the one hand, she knows the house is a really valuable asset, but she feels that she’s been fortunate to ride the boom – they didn’t know the area would go the way it has. She also feels a little guilty that the kids are not going to have the same opportunity.

Meanwhile, she’d love to have some more cash behind her. She spent a lot of years when the kids were younger without a safety net, and the idea of that continuing into her later years terrifies her.

The good news is that she also has very few debts – in fact, she’s only got the mortgage with a credit card. The card has a $5,000 limit, but Tracey very rarely uses it so it’s sitting at $0.

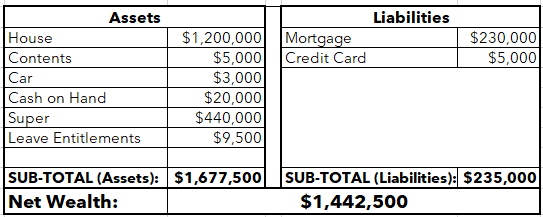

Her Balance Sheet

Putting this all together gives us this balance sheet:

Obviously, this is a healthy level of net wealth. But it doesn’t really ring true for Tracey because:

-

She needs somewhere to live, so she feels like that $1.2m figure is a bit meaningless.

-

We’ve absolutely minimised the value of her home contents for reasons that’ll become clear later – she knows it’s all worth more than that.

-

We’ve included her maximum credit card limit, even though there’s currently $0 outstanding.

Which is why, with a net wealth of nearly $1.5m, Tracey feels incredibly insecure about her financial future and, frankly, scared by the idea of retiring.

A Long Time Retired

Because Tracey appreciates that you’re a long time retired – and your nest egg needs to sustain you for as long as possible.

Tracey’s aware of the Age Pension, and she also knows that she’d rather not solely rely on it in her retirement. She desperately wants to avoid being “one of those pensioners who can’t afford to turn the heater on”.

But she’s also done the sums in her head:

-

It costs her around $48,000 a year to live now

-

She has $440,000 in her superannuation

-

$440,000 divided by $48,000 is 9.2.

-

So her super might last her between 9 and 10 years when she retires.

Tracey is 64 now, so the idea of her money running by her 74th birthday worries her.

A lot.

So she keeps on working.

“I’m never going to be able to retire! They’ll have to carry me out of here in a box, I can’t afford to stop working!”

And in our next few posts, I’ll take Tracey through a plan that can help her to change this – and why, maybe, she doesn’t need to worry quite so much after all.