The cost of financial advice in Australia is a hot topic at the moment. And I thought I might spend some time exploring how much advice costs, why it costs that much and what goes into that cost.

This first-in-a-three-part series will address the costs that go into providing financial advice in Australia.

Is Financial Advice Expensive?

That’s a lot more expensive than I was expecting.

Oh, wow, that much?

Why’s it so expensive?

These actual quotes we’ve heard from people over the last year or two would be familiar to any financial adviser working in Australia today. Especially those of us providing financial advice after their divorce.

And I get it – it’s real money people are investing in our work, so I’m very conscious of our fees.

But regardless, there is a cost to valuable financial advice. And that cost is worth examining, I think.

Basically – why is financial advice so expensive and is it really worth it?

So I thought I’d take some time to discuss:

– Some of the costs that go into providing financial advice;

– How financial advice fees are calculated;

– The intangible benefits of great advice (and the tangible process for the measurers out there);

– Why it is almost impossible to overpay for great quality advice.

Useful? Maybe, Maybe Not

I also know that, for some people, this information will be useful when they’re deciding whether or not to engage professional financial advice.

But for others, it won’t be.

Regardless of the reasons, the cost of this advice is simply too high.

The glib response is to say ‘wait till you see the real cost of bad advice’.

Which is easy to say if you ignore all of the negativity surrounding financial advice in Australia.

In such an environment, glibness doesn’t help people with real complexity in their financial lives, but who still view financial advisers with real trepidation.

I can’t really address that in this series, but I would encourage you – if this sounds like you – to speak with a few different advisers.

In fact, reach out to me and I can pass on some names of really wonderful people who happen to be financial advisers.

And, with that, let’s return to our discussion around the costs of financial advice.

What Does It Cost to Provide Financial Advice?

There are two answers here – ‘nothing’ and ‘quite a lot, actually’.

And I say ‘nothing’ because, at its pure essence, financial advice is the same as all advice – it is simply the transfer of knowledge from one person to the other.

That transmission of knowledge doesn’t actually cost anything. But it’s not quite as simple as that.

Especially in financial advice.

Because while every business has costs to operate, there are some costs unique to financial advice that make it a little more complicated.

It’s worth knowing that there are a few different layers of cost that form the framework advisers operate within here in Australia.

1. Unique Costs

Here’s a good point for a quick overview of the structure financial advisers operate within in Australia:

Under the Corporations Act, providers of a financial service need an Australian Financial Services Licence (AFSL) to operate.

The Australian Securities and Investment Commission (ASIC) apply the guidelines of the Act to approve applications for AFSLs.

But holding an AFSL can be an onerous task with serious consequences for non-compliance.

For this reason, many financial advisers choose to operate under an AFSL of a bigger company.

That AFSL will then have a set of rules for their ‘authorised representatives’ (advisers) to follow when advising people.

These guidelines – referred to generally as ‘compliance’ – shape what we can advise on, how we provide that advice and when we provide certain documents.

This ‘compliance’ sits atop our general obligations under the Act, ASIC regulations and other professional requirements.

Licence Costs

These AFSLs are standalone businesses, maintaining their licence and ‘authorising’ advisers to operate within their licence.

There is, naturally, a fee associated with this service.

These fees vary across the sector – with the inclusion of other costs like software, insurance and business development affecting them as well – but it’s safe to assume that your financial adviser is paying anywhere between $25,000 and $75,000 a year to their AFSL.

This cost, it is worth pointing out, is simply to be able to give financial advice.

Government and Regulatory Costs

In addition to this cost are some of the regulatory expenses that come with running a financial advisory practice.

One example is the annual ‘Financial Adviser Levy’ charged by ASIC each year.

As it’s currently structured, ASIC levy a charge of $1,500 upon each AFSL plus $1,142 per adviser (as of 2020)[1].

(Another sidenote – this fee increased by 26% in 2020. 26%.

Inflation, for comparison’s sake, was 1.8% for the year to December 2019[2]).

Another regulator worth noting is the Tax Practitioners Board (TPB).

All advisers had to apply to the TPB a few years ago – $550 per adviser, plus $550 for their company application as well – and also need to renew that membership every three years – another $550 per adviser, plus another $550 for the company[3].

Professional Indemnity Insurance

Financial advisers are also required by law to hold adequate Professional Indemnity insurance. This isn’t unique to financial advisers, of course, but it is a cost, nonetheless.

Again, it’s difficult to generalise a figure like this – it’s different for each AFSL based on their specific risks and practices.

But a fair rule of thumb is anywhere between 2-4% of an advisers revenue goes towards these premiums[4].

Adviser Associations

Some advisers then choose to belong to one of the adviser associations as well.

The two most prominent ones – the Association of Financial Advisers (AFA) and the Financial Planning Association (FPA) – cost between $595 (FPA[5]) to $840 (AFA[6]).

These associations also offer additional designations, such as the Certified Financial Planner (CFP) offered by the FPA.

This adds an extra $500 a year to the annual fee (including a $200 advertising levy).

Quick Summary

There’s an assortment of other costs that pop up here and there – ongoing education expenses, software, but they’re consistent with other professions as well.

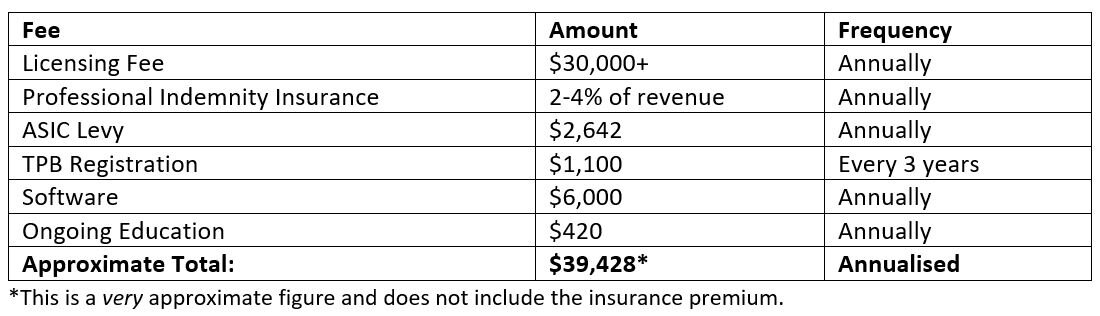

It might be best to try and summarise these costs here, try and dilute the alphabet soup we’re swimming in:

It’s worth considering this the baseline cost of operating a practice in Australia – this is before any advice is given to anybody.

2. Usual Costs

There are then the other considerations, such as:

– Staff;

– Rent;

– Loan repayments;

– Usual office running costs.

These are simply the cost of running a business, so I won’t go into further detail, as I’m sure you can understand.

We Have Our Baseline

So, between the Unique and Usual costs, you have a good idea of what it can cost to run a basic, small financial advisory firm.

Adding additional staff, advisers, premises, etc, will all significantly increase this cost base.

As you can understand, this ‘cost base’ forms part of the algebra around working out your fees.

There are a few other considerations as well.

The Value of Great Advice

The financial world is complex, with confusing jargon, illogical laws and a complicated interplay between the rules, regulations and strategies.

Learning the ins and outs of this system isn’t easy. And that’s just the ‘technical’ complexity of staying up to date with the laws, ideas, tactics and opportunities available to people within this system.

Layer on top of that the steps required to keeping current with developments in the ballooning world of financial products.

Then incorporate the wonderful challenge of communicating that information to an endlessly different audience of people – each with their own biases, preferences and fears.

And, finally, consider working in this space whilst complying with the fluid landscape that is financial services regulation in Australia.

Consider that complexity, and it becomes clear why most people don’t want to take responsibility for navigating this minefield alone.

Many people are looking for a guide to help them find their way. And there’s real value in the services of that guide.

This question of value is almost impossible to quantify in an article like this and will boil down to your experience, values and belief in your adviser.

It is important, though, to recognise that this is another part of the calculation that goes into working out how much that advice will cost.

Lingering Liability

There is another consideration that I won’t really explore in detail in this piece – the liability your adviser assumes each time they provide advice.

Rightly, every adviser assumes responsibility for making sure that the advice they give you is appropriate and in your best interests.

This responsibility comes with a serious liability that, in the event we got something wrong, we will wear the consequences of that error.

Be it covering the financial impact, working through a formal complaints process, or bearing some form of out-of-pocket cost, this liability needs to be a serious consideration for any adviser in pricing their advice.

I should emphasise – this is how it should be.

We are providing advice about people’s money.

This needs to come with a heavy burden to make sure we take that responsibility seriously and conduct our work in a way reflective of that seriousness.

But I think most people appreciate that there is an additional cost for the services of somebody assuming that burden.

And these four areas:

-

Costs unique to the financial advisory world thanks to the unusual structure

-

The usual costs of running a business in Australia

-

The value great financial advice can add

-

The serious and reasonable liability each adviser takes on by giving advice

Form, in my opinion, the basis of financial advice fees.

The next article in this series will detail some of the options you have for how you choose to pay for financial advice – and how advisers work to align these options, their fees and where they see their value being.

References:

[1] https://www.professionalplanner.com.au/2020/01/adviser-levy-blowout-due-to-royal-commission-asic/

[2] https://www.abs.gov.au/ausstats/[email protected]/lookup/6401.0Media%20Release1Dec%202019

[3] https://www.tpb.gov.au/renew-your-tax-financial-advisers-registration

[4] https://www.professionalplanner.com.au/2020/02/pi-insurance-woes-to-continue-another-2-years/

[5] https://fpa.com.au/membership/become-a-member/

[6] https://www.afa.asn.au/membership