Welcome (back) to our Six Stones series. Our financial adviser, Jordan, is sharing as many tips, ideas and advice for people going through a divorce as a humble blog will allow. He’s staying away from specific financial advice – it’s all general advice over here, be sure to get personal financial advice before doing anything – but we hope you find some useful information in here as you navigate through/out of your divorce.

Our last post was all about helping Louise articulate the worries she has about what would happen if she were to pass away.

By recognising and assessing this risk, Louise is well on her way to having her personal risk management plan started.

This process allows here to work out which of the 5 management methods she’d like to deploy to help her address this risk:

-

Accept

-

Avoid

-

Transfer

-

Mitigate

-

Exploit

But before she can do that, there’s one more step we need to take – quantifying the risk.

Quantifying the Horrible

To help Louise really gauge the Impact of her passing away (for the purposes of calculating her risk management equation – Likelihood x Impact), we worked to quantify the figures around her Worries.

It’s terribly difficult to put anything so crude as numbers around tragic circumstances like someone dying.

Yet, there are financial consequences to death, sadly, and by taking the steps to work through them methodically now, we can prevent the additional stress and pain money troubles can inflict at the worst possible moment.

We can also step through what Louise wants to leave behind to make sure that her big fears are taken care of.

The Numbers

As a quick reminder, Louise wants to make sure:

-

The kids are taken care of – their school fees are paid until they finish school and they receive a small boost to help them get a great start in their adult lives;

-

All debts are cleared;

-

Provide an income for her kids to help fund their lifestyle until they reach adulthood;

-

Provide for her mother as she nears the point where she’ll need to move.

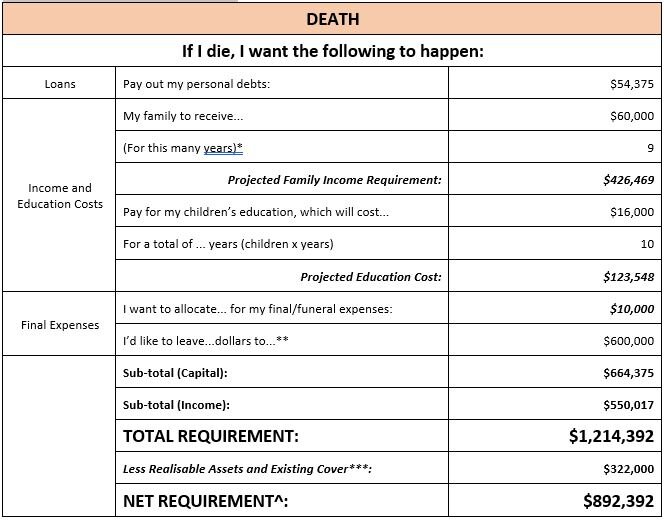

Based on Louise’s Worries, we were able to plug some numbers into our calculator to show her what the financial Impact would be:

Taken from our calculator, but the sums involved are pretty straightforward and very doable at home.

Some quick notes on these figures:

*Until Lara is 21

**$200,000 to each of the kids, and $200,000 to go towards Louise’s Mum’s care arrangements

***Less Louise’s net superannuation and cash savings.

^Arranging the final structure of Louise’s final wishes is beyond the scope of this discussion, but appropriate legal advice should always be sought when making such arrangements.

What It Actually Means

As crude it sounds, these numbers give us an idea of the financial impact of Louise’s death.

In other words, if Louise were to pass away tomorrow, the financial Impact would be approximately $892,000.

You’ll also note that by doing this, we have half of the risk management equation, being:

Impact x Likelihood = ‘Risk’.

Of course, the Likelihood is not something we can examine here, but knowing the Impact is incredibly valuable.

Knowing this, we can:

-

Examine some of our assumptions – for instance, does Louise still want to provide that level of assistance on the school fees? Will $200,000 be enough to help her Mum when the time comes?

-

Work out the ‘next steps’ in the event of Louise’s death – who should what money, and when?

-

Add these specifics to Louise’s Risk Management Plan.

Speaking of…

Louise’s Risk Management Plan

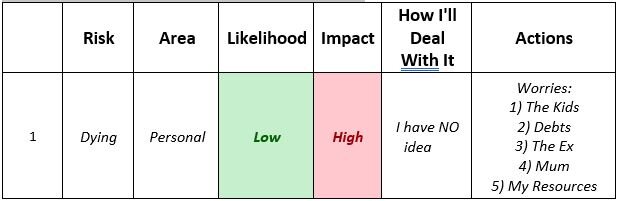

With this context, we can start constructing Louise’s Risk Management Plan too.

In this case, we’ve Identified the risk (Louise dying), Categorised it and now we can help her Decide how she’s going to deal with it.

Louise has entered this into her Risk Management Plan:

We’ll park this discussion for now as we move on to the other big risks, but I want to highlight that working out ‘How I’ll Deal With It’ (about which we’ll go into more detail later) is a big question that’ll need to be answered for Louise to feel more comfortable about this risk.

Now that we’ve addressed this particular worst case scenario, it’s on to the one that personally frightens me most – disability.