Welcome (back) to our Six Stones series. Our financial adviser, Jordan, is sharing as many tips, ideas and advice for people going through a divorce as a humble blog will allow. He’s staying away from specific financial advice – it’s all general advice over here, be sure to get personal financial advice before doing anything – but we hope you find some useful information in here as you navigate through/out of your divorce.

We’ve spent the last few posts applying our Needs / Wants / Worries categories to your personal spending arrangements, categorising your historical expenditure to give you an idea of what you’re working with.

Then we outlined the theoretical structure for your Money Management system – from Needs, to Smile and Joy, and through to your Safety ponds.

And the simple ratios you can use to help guide how you allocate funds through your Money Management system.

Now – how does this work in real life though?

That’s Not How Real Life Works

Well, the ratios simply become the ‘target’ of how the water could flow.

And the beauty of the process is that if you’re not on target, you can easily tell why (by looking at your Budget Tool sheet) and work out if that’s a compromise you’re happy with.

If you are, then fantastic, full steam ahead.

But if you’re not, you can then examine your numbers really quickly to get an idea of what you need to address.

Conscious decision making – it’s pretty great!

But let’s work through an example.

Meet Louise

Louise is 46 and works as an office manager at a local law firm. Her and her ex separated two years ago and while it was tough telling their two kids, it was undoubtedly the right thing to do.

Louise recently finalised her property settlement with her ex, a few months ago. All of the required transactions have been done.

They had to sell the family home, but they’ve split her ex’s super between their two accounts. She’s kept one of the cars but had to take on the rest of the 5 year loan that’s linked to it.

One decision she made that she thought might be a problem, was to stay in the same area after they sold the house.

She’s moved into a smaller house a few blocks from their old home, with enough room for the two kids, Labrador and three budgies.

While she’s still dealing with everything, she is getting really worried about how much money it costs to be her.

She can’t put her finger on it, but she has a really strong feeling that things are spiraling away from her.

Explore / Analyse / Diagnose

Louise has taken the time to collect all of the historical info she needed to put together a mostly-accurate snapshot of where she’s spent money in the last three months.

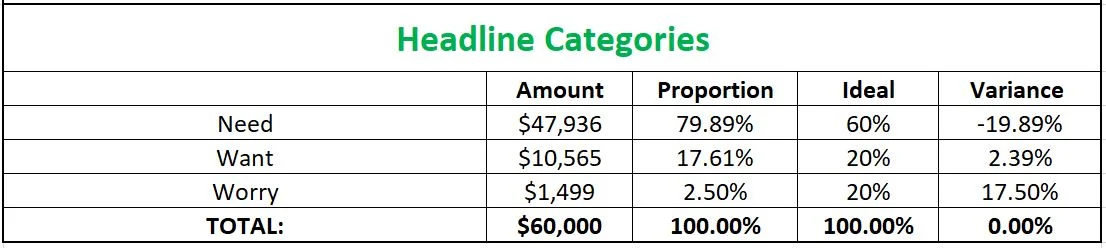

In doing so, Louise has worked out that her post-divorce, $5,000 net (everything we’re doing is net, which means ‘after-tax’) monthly income is flowing as follows:

What’s clear from this snapshot is that a big chunk of Louise’s income is going towards her Needs.

Which isn’t entirely surprising – it’s likely that’s the cost of choosing to stay in the local area to give the kids social continuity.

But, still, it’s a big variance.

This variance means that Louise isn’t able to put much towards her Worry bucket – which is how she’ll build up a buffer against life’s unfortunate side.

It also means that she’s not able to fully spend the Ideal Want allocation, which does detract from her enjoyment of life.

Given that the reason Louise looking at this is because she’s worried about not being in control of her money, it’s worth digging deeper to find out more about what’s driving this.

Digging Deeper

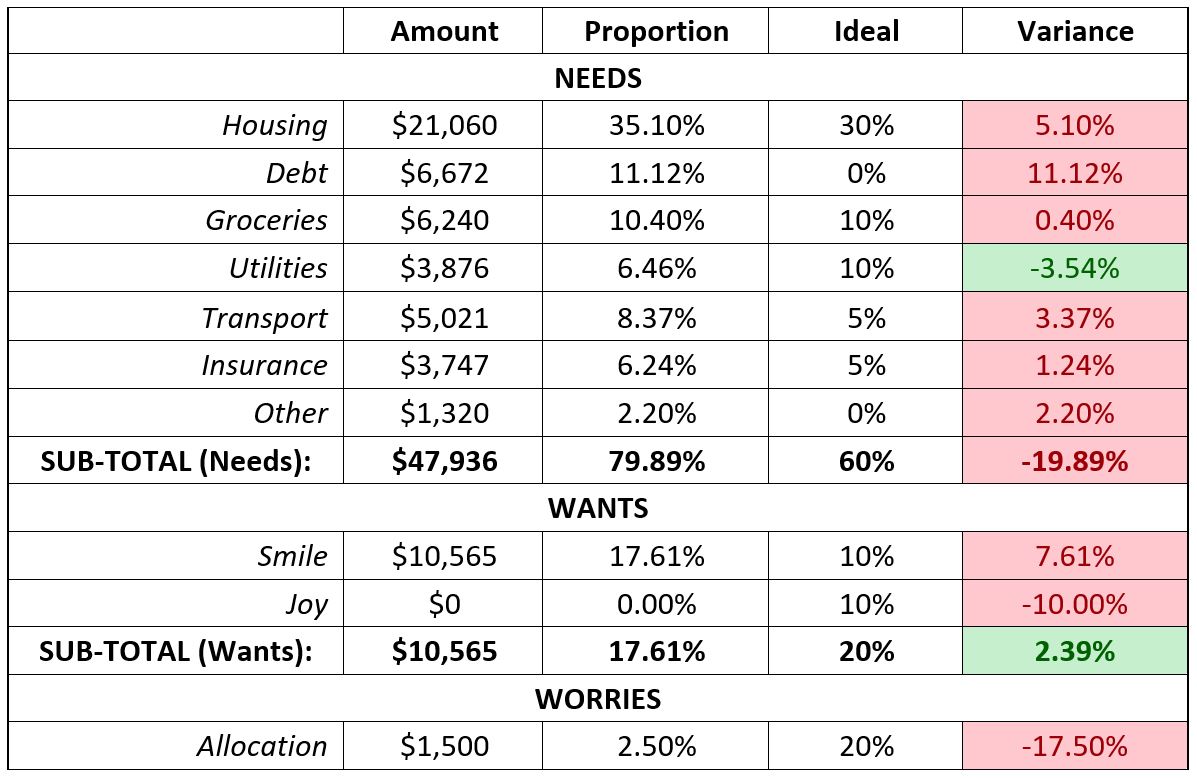

The next step for Louise is to breakdown her expenses in more detail to find out what’s pushing her Needs so far beyond the Ideal.

Looking at the data at this level, the drivers are pretty clear:

– The rent Louise is paying ($1,755 per month) is pushing her Housing costs 5.1% higher than her income can comfortably support;

– The car loan she’s carried on after the divorce, which is costing $556 per month, is blowing apart her Needs budget to the tune of 11.12% in extra costs;

– The remaining parts of her Needs budget are also over, expect for the Utilities.

Armed with this information, Louise can identify what it is that’s making her so uncomfortable – and decide what to do about it.

If she decides to make changes to dilute that feeling of uncertainty, she has a few options:

– Louise can make the difficult decision to move somewhere that will bring her rental cost under the 30% mark (anything under $1,500 per week);

o Or Louise can accept the budgetary pressure because she loves where they live and staying in this area makes life easier for your kids for now.

– Louise can work out what she’d like to do with the car.

o Does she have other savings she can use to clear the loan and take the pressure off her monthly cashflow?

o Or can she trade down to a cheaper car? (Assuming selling the current car would cover the loan amount, which isn’t always the case)

o Or is it better for her to divert all spare income towards the car loan to get rid of it? Absorb a few more months of difficulty for a longer-term benefit?

Let’s look at what the second option might mean for Louise.

No Car Loan, No Worries?

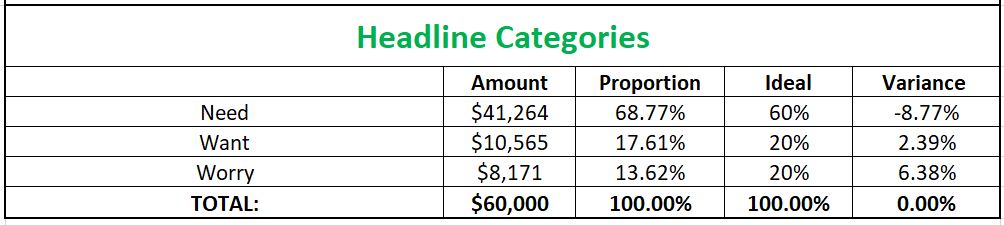

So, what would it look like if Louise did pay out her car loan?

Well, it looks good, frankly.

Assuming the sale of her car covers the loan payout and she’s able to find a suitable replacement option within her budget, once that debt’s gone her budget changes drastically:

Not quite at 60%, but still a big improvement.

Adding an extra $6,672 a year to her Worry bucket will make a really big difference over time.

She can then divert that towards building up a real buffer, which will give her even greater peace of mind.

Or she can use it to start topping up her Joy account which she can put towards a break with her kids next summer.

Or she can do a mix of the two.

Either way, she’s doing it based on the information in front of her.

Dilemmas, Decisions and Compromises

And now we’re really in the groove.

Instead of making decisions based on impressions and suspicions, Louise can make informed decisions based on the information she already has at hand.

(Collecting the initial batch of data is way harder than updating it as you go along).

In this case, Louise can make a decision about where to live based on what’s best for her, her family and her financial future.

Either way she decides to go, it’s a conscious, informed decision that she can own, that’s hers alone. And that’s incredibly powerful.

Each decision like this – based upon solid data and made within her own personal context – layers upon the last, with each one contributing to her feelings of clarity, control and confidence.

That’s one of the brilliant parts about freeing up a surplus in your budget. It gives you options.

And this isn’t by doing anything particularly dramatic – this is simply by paying out a car loan.

This will help her maintain a nice standard of living today without having to worry too much about tomorrow.

This won’t happen right away, of course.

But I think you’d be surprised at how much you can do in the next three months.

No Judgment

A quick aside here as well – remember, we’re not here to judge the decision, just to help Louise make more informed decisions.

If she decides to stay in the more expensive area, then that’s fine. And if she wants to keep the car, and the car loan as well, then she does so knowing what that means for her budget.

Sure, any savings need to come from elsewhere in her budget. But that’s Louise’s decision. It’s our job to give her the information to make that decision.

Or, if there are no savings available, then we need to let Louise know that the holiday she’d like to take isn’t achievable in the short-term.

But once she’s made her decision, she can feel even slightly more confident about her choices.

Revisit and Reset

This isn’t a set-and-forget exercise, either. Especially not in the first 12 months or so.

It’s an ongoing piece of work, with scenarios and reviews and discussions and compromises made, revisited and reset.

Which is totally, utterly normal!

You’re adjusting your approach to bring it in line with your new life.

But having this data behind you makes that process that much smoother – and, most importantly, lets you take control of it so that you’re making the decisions.

That’s where confidence comes from.

In our next post, we’ll take you through how Louise can set up her banking to automate as much of this process as possible.