Welcome (back) to our Six Stones series. Our financial adviser, Jordan, is sharing as many tips, ideas and advice for people going through a divorce as a humble blog will allow. He’s staying away from specific financial advice – it’s all general advice over here, be sure to get personal financial advice before doing anything – but we hope you find some useful information in here as you navigate through/out of your divorce.

Our last few posts have been about the difference between an ‘accidental’ and a ‘deliberate’ banking structure.

In this post, we’ll talk about the actual mechanics of setting up your accounts.

A Bunch of Bankers

You probably have a relationship with a bank already.

If you’re like most people, you don’t have any particular fondness for them but hey, you’ve always been with them and it’s too hard to change stuff.

Which I get. Changing direct debits and cards and PINs is a real pain in the neck.

But sometimes simply re-purposing your current accounts just isn’t enough. You may need to set up new accounts.

So – how to do it?

There are a few options.

You could check out the internet to find the very best one for you, and use our Priorities table from the last post to help you decide.

You could reach out to a few of the more active personal finance groups for further guidance.

But, for simplicity’s sake – and with a conscious acknowledgement of how much change you’ve already been through – you could also just go to your current bank and work with them to ‘audit’ your current accounts.

I know, I know.

Banks – especially the Big 4 – are the enemy. And I don’t disagree.

But.

One of the unspoken benefits of an uncompetitive oligopoly is that the products all start to look alike.

For a large part of the population, it doesn’t really matter which bank it is because most of the products are the same.

This is, of course, a gross generalisation. If you want to shop around for the very best deal then that’s definitely the way to go.

But in my experience, people that have been through, or are going through divorce, don’t really want to make even more changes while in the change tornado.

So – for now, and for convenience’s sake – consider going into your current bank to get it all looked at.

Account Audit

And make them work for you. Ask them a heap of questions and be demanding – they’re certainly earning their pound of flesh from us all.

Ask them questions like:

-

Do my accounts meet the criteria we’ve outlined above?

-

If not, why not?

-

What’s different?

-

What’s the trade-off you’re getting for not getting much interest, for instance?

-

If they’re not suitable, can your bank help you (re)build your banking structure with deliberation and care?

If your bank – or banker – can’t help you, then have a look online.

The Australian banking landscape has really opened up in recent years, and there are quite a few options out there that perfectly fit your requirements.

Cui Bono

“Cui Bono” is a good question to ask anyway, and is one of the more useful pieces of Latin that has lodged into my brain somehow.

It means, loosely – to whose benefit?

And it’s worth keeping in mind in any financial discussion, transaction or investigation.

To whose benefit is it that I open this account?

To whose benefit is it that I close this account / keep this credit card / take this loan / take this insurance?

Because in my experience, many bank staff are, for better or worse, incentivised to open more accounts and to cross-sell you into other products like term deposits, insurances, debt and credit cards.

Many of them have to labour under bananas ‘scorecards’ that often prioritise sales over service.

So they may – in that environment – be tempted to suggest products and services that you don’t necessarily need. Or that may not be in your best interests.

My suggestion?

Politely decline these offers and focus only on the accounts that you need to open – not the products they need to sell.

Account Specifics

We can’t really get into specific products or options here – the rules we operate under deem that as financial advice, which makes it a real no-no.

But.

Many of you will be wondering – ‘can I use an offset account for any of this?’.

We talk about this more in our Improve module – what an offset account is, how it can be used, etc.

But the short answer is – sure, you can use an offset account for this.

Provided:

-

It meets the criteria outlined in our previous post;

-

It gives you the appropriate functionality for the account type;

-

It doesn’t bring a whole bunch of extra fees or costs into your life.

Cards, Cards, Cards

One of the questions you’ll also need to answer is which cards should you have, use or cut up.

The good news is that the answer to this flows from the structure we’ve built.

So – you don’t really need a card for your Buffer account. That’s your ‘rainy-day’ fund, so when you need it you’ll be able to go to the bank to get it out.

Of course, you may need it when you’re on the side of the road waiting for a tow truck – in which case you use one of your other cards in the moment, and transfer it back across when you get to a bank.

But you will want a debit card for your Smile account. Tap and go, or PayPass, is fine here because you’ll be using this for lots (dozens perhaps) of smaller transactions a month.

So get this card and – in the pattern of Mr Scott Pape – draw a smiley face, or a big S on the front of the card. That way you’ll know which one is to use for your short-term Wants.

For your Needs account, a card is handy.

You’ll likely be using this for any online bill payments, etc, and paying via their card portal can sometimes be easier or safer than using BPay or Direct Debit.

Which means definitely get this card – but maybe leave it at home. This also helps avoid the temptation of using it during the week.

Finally – you don’t need a card for your Joy account.

Because it’ll be linked to your Needs account (the Needs, Joy and Smile accounts will all be linked to allow for easier transfers of money between them) and any Wants coming out of there will be planned in advance, you can just transfer the cash from Joy to Needs or Smile when the time comes.

Then you’ll use that card to pay for that cracking holiday to Europe you’ve just booked.

The End Product

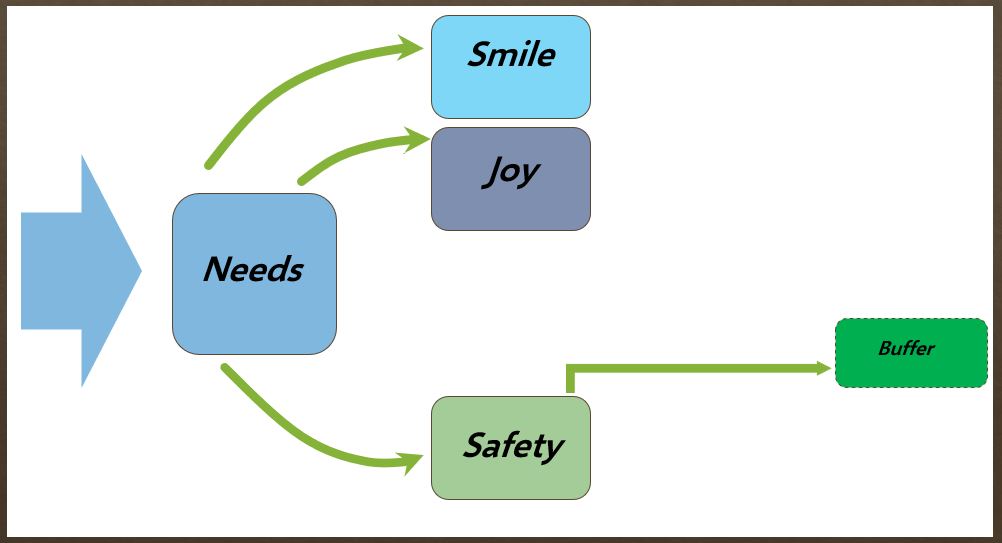

Anyway, at the end of the process, your banking structure will look something like this:

This structure:

-

Makes it easy to ‘stream’ your income to the appropriate ponds using your chosen ratios;

-

Helps you to see where your money is;

-

Means you know where your money is going – and why it’s going there.

And that’s the Banking section of the 3 B’s. My next post will bring it all together and show how Louise can now set up her income to flow through her banking structure, in line with her goals and objectives.