Welcome (back) to our Six Stones series. Our financial adviser, Jordan, is sharing as many tips, ideas and advice for people going through a divorce as a humble blog will allow. He’s staying away from specific financial advice – it’s all general advice over here, be sure to get personal financial advice before doing anything – but we hope you find some useful information in here as you navigate through/out of your divorce.

We’ve examined what people might like to see happen in the event of their death, disablement or serious illness if money were no object.

It’s important to do this in the way that butcher paper is important when brainstorming – it helps capture the full range of priorities and considerations in such an awful time.

But the unfortunate reality is that money is an object, one that limits our options and constrains our ideas.

So after reconsidering ones priorities in these events – like Louise did in our previous chapter -the continued existence of the Gap can be a real kick in the pants.

This residual Gap is much harder to bridge and can only be done in two ways:

– Dropping your expectations;

– Increasing your resources.

Dropping Expectations

I think it’s fairly intuitive that the Gap sits between two concepts – your expectations and your resources.

Modifying your expectations – perhaps accepting that the kids won’t continue in private school if you were to pass away, or prioritising clearing the mortgage over upgrading to a new house – can help close the Gap significantly.

Take Louise as an example.

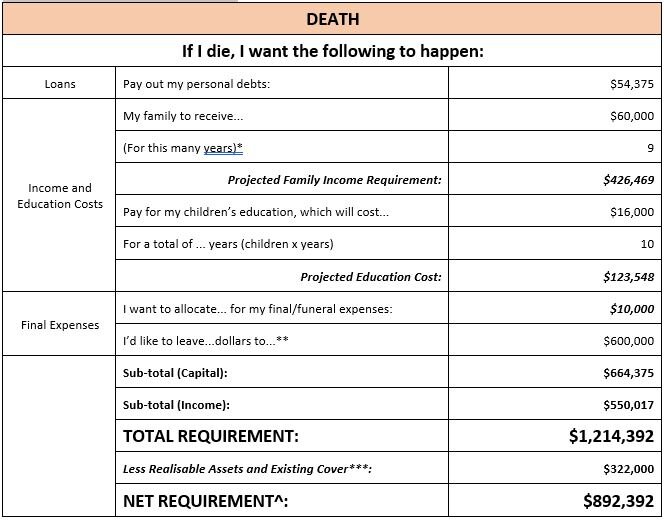

If she were to pass away, Louise wanted to provide for the following:

*Until Lara is 21

**$200,000 to each of the kids, and $200,000 to go towards Louise’s Mum’s care arrangements

Central to her wishes are:

– Paying for the kids private school education;

– Giving the kids a ‘boost’ into the property market;

– Contributing to the funding of her Mum’s future care arrangements.

These three expectations total $723,548. Louise’s current Gap, after the initial adjustments in our last chapter, was $892,392.

If Louise were to forego all of these expectations, this Gap would close to $168,844 – a far smaller level of exposure for her.

But of course allowing for less would mean a lower target. The bigger question – that only Louise can answer – is which expectations she wants to drop or reduce.

Perhaps Louise decides to prioritise funding her Mum’s care arrangements, but decides the kids private education can be enough of a ‘boost’ into their future so they don’t need the extra cash payment.

Again, Louise is able to have these conversations because she’s done the hard work of collecting the data and exploring the scenarios.

This discussion around expectations is being done with a full understanding of herself, her wishes and her financial reality.

That’s a lot better than “I can’t afford to do that, scrap it all.”

Increasing Your Resources

Reviewing your resources, choosing which ones to apply to your risk management plan and also modifying your expectations all help to lessen the malevolent power of the Gap.

There is another way to close the Gap as well. It’s not an alternative path, rather a complimentary one.

Increasing what you already have.

This isn’t some sort of hand-waving, glib declaration of ‘just have more wealth’. But there are tweaks you can make to your risk management plan to apply this possibility:

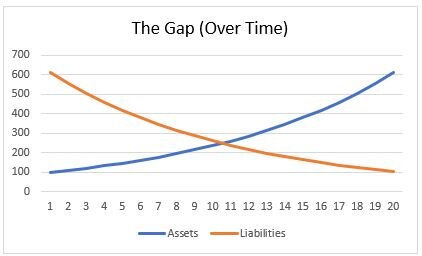

– For instance, a general rule of thumb is that over time your level of risk should fall. As your loans are repaid, your children progress through school and the time between ‘now’ and retirement drops, your financial exposure will also decrease.

After all, repaying a $500,000 mortgage if you were to be disabled in year one is a bigger job than repaying a $300,000 mortgage in year ten.

– At the same time – barring a lasting economic and financial calamity – your assets should also grow over time.

Hopefully your superannuation will grow with the accumulation of your contributions, the value of your home may climb and your ability to grow your asset pool could increase over time.

This can be accelerated via an investment plan and it can also be mapped with some reliability into the future.

It’s not a difficult mathematical exercise to answer “If I put $100 a week into my mortgage, how quickly will it drop?”

And so, all going well, the chart of your financial risks should look like this:

Congratulations

That intersection around year 10 is where the financial impact of your death, disability or serious illness is zero.

That’s right, zero.

Nada. Zilch. Nothing.

Your resources match, or exceed, your expectations.

Congratulations – The Gap is gone!

But what about those 10 years where the Gap is lingering around like an unwelcome house guest, taking up space in your mind?

Well, that’s where insurance comes in.