Welcome (back) to our Six Stones series. Our financial adviser, Jordan, is sharing as many tips, ideas and advice for people going through a divorce as a humble blog will allow.

He’s staying away from specific financial advice – it’s all general advice over here, be sure to get personal financial advice before doing anything – but we hope you find some useful information in here as you navigate through/out of your divorce.

Now that you’ve invested the time and emotional energy into working out what you’d want to occur if you were to pass away, be disabled or fall seriously ill, it’s time to look at just what to do with that knowledge.

In other words, we’ve:

– Identified the risks;

– Categorised them by working out the financial impact, and combined that with the likelihood of them occurring.

Now it’s time to Decide what we’re going to do about it.

The Gap

If you’ve ever spoken to a professional financial adviser, you’re probably familiar with ‘The Gap’.

It’s the difference between what you have now and what you want to have.

The gulf between the destination you’re current path is taking you to – and the place you really want to get to.

When it comes to risk management, it refers to that ‘gap’ between what you could use now if one of these events occurred and the actual impact.

There’s a Name For It

In real life, it’s this ‘gap’ that keeps people up at night, worrying about how they’d make ends meet if they got sick, or if the kids would be able to stay at school, or any other of the million things that invade our brains right before we drift off.

This ‘Gap’ is why people need to work on their laptops whilst going through chemo, or why families need to move out of their home when the breadwinner dies.

It can be the difference between the freedom to live a full life in your wheelchair and being housebound by a lack of options.

It’s important.

And (finally) some good news – you’ve already done a big part of the work by Identifying and Categorising the risks that make up your own Gap.

Putting a figure to the Gap is a crucial part of reducing the space these risks can take in your head space.

Now, let’s return to Louise.

Getting There

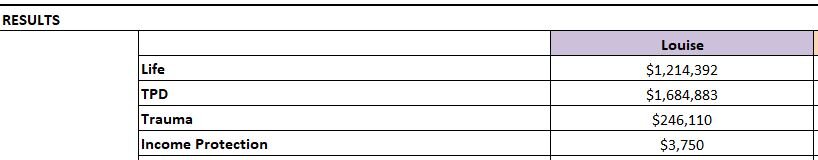

As we worked through the Big Risks with Louise, we were able to calculate the (financial) Impact if she were to pass away, be disabled or fall critically ill.

This gave us the ‘gross’ figure. There are a lot of calculations that go into this figure, but to summarise the results, here’s the gross financial impact

For example, if Louise were to become disabled, she would need $1.685m to fully meet her requirements and expectations.

This is, clearly, a significant number.

The next step, then, is to see what we can do to try and close the gap.

Step 1 – Assets You Can Rely On

First off, what assets does Louise currently have that she could use in such a time of need?

We know Louise has $145,000 saved in the bank and $135,000 in her superannuation fund. She also has a car, worth $42,000.

Louise hasn’t allocated the money in the bank to any particular purpose as yet, and is comfortable assuming she’d use that money to meet the ‘Gap’.

We also know that if Louise were to die or be disabled, she could access her superannuation (this is a big topic, too big to properly cover here. Definitely speak to a financial adviser for how this might apply in your case).

The car is a slightly trickier proposition – they’re notoriously unreliable when it comes to value, but in Louise’s case she insisted that her family could sell it for $42,000.

So, all up, Louise has $322,000 in assets she could put towards the ‘Gap’ if she died or was disabled.

But if she fell ill, Louise wouldn’t automatically be able to access her superannuation. Which means she ‘only’ has $187,000 in assets to access in that case.

And when we talked about what might happen were she to fall ill, Louise declared that she should probably keep the car for ‘when I get better’.

Quick Adjustment

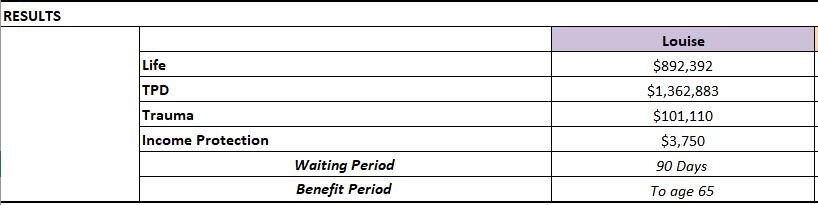

Knowing these figures, we can adjust our ‘Gap’ calculation to incorporate these assets.

By working through the events that might occur if one of these horrible Big Risks happened to Louise, she’s already been able to close the Gap by:

– 27% if she were to pass away

– 19% if she were disabled

– 59% if she was critically ill.

I know I keep saying it after each step – but simply taking this step has brought some peace of mind for Louise.

In my next post, we’ll keep going through the steps involved in Closing The Gap.