Welcome (back) to our Six Stones series. Our financial adviser, Jordan, is sharing as many tips, ideas and advice for people going through a divorce as a humble blog will allow.

He’s staying away from specific financial advice – it’s all general advice over here, be sure to get personal financial advice before doing anything – but we hope you find some useful information in here as you navigate through/out of your divorce.

I said earlier that money isn’t everything when it comes to looking at these big risks.

And I meant it – events like death or disability or serious illness are far bigger than money.

They’re deep, important and unfortunate parts of life and their impact echoes well beyond the financial pond.

However.

Money will dictate your experience of them.

Because money provides options, it provides choice, it provides a level of comfort that people experiencing death, disability or serious illness will crave.

And on the other side of the ironically referenced coin, the lack of money will shrink the possibilities, reduce perspectives and limit options.

For instance – the difference between an entry-level wheelchair and it’s more luxurious cousin will, for most of us, remain theoretical.

But when you’re the one being helped by your family to pick where you’ll spend hours upon hours of your life, the freedom to avoid pinching pennies is a distinctly empowering one.

Take this scenario and multiply it by the practically endless choices and decisions people going these big risks and you’ll see why money – while not everything – is still important.

Really, really important.

Especially the money we rely on as income.

A Gaping Hole

For the vast majority of people, falling ill or being disabled (we will, naturally, ignore your income requirements post-death for this discussion) will reduce – if not eliminate – the income they receive.

Perhaps they have some sick pay, maybe there’s a benefit payable from their super, but for most people their income will, eventually, simply stop.

This can be a devastating moment, for even the best prepared person.

And the disappearance of that weekly, fortnightly or monthly payment will leave a gaping hole in the finances of that household.

Even If

Even if…all of the debts have been paid out.

Even if… all of the costs of the New Life have been provided for.

Even if…all of those extra costs – wheelchairs, taxi fares, non-PBS medications, respite care, all of the ‘new’ costs that come about have been funded.

Because that doesn’t change the core reality of having enough money to live, every day.

To pay for the registration on the modified car.

To buy pizza for the family at the end of a long week.

To buy a new pair of shoes for your son, or a school uniform, or an excursion, school camp, lunch order.

To make sure the rates are paid, the house insurance is covered, the car stays insured, roadside assistance is taken care of, petrol can be put in the car.

To ensure the lights stay on, gas keeps flowing, water keeps running and the internet – by God, the internet – stays connected.

They Don’t Also Disappear

These costs, and a million other ones, don’t disappear simply because you’ve been diagnosed with cancer or been in a car accident.

Not only can these costs quickly become a serious burden for the unprepared – many of them can be a link back to the life you had.

For many people, they bought groceries before they lost their mobility, so buying them afterwards can be some small amount of empowerment in a tough time.

In other (and far fewer) words – income is an important part of any risk management plan.

Actions You Can Take NOW

We’ll talk about the specific options available to you once you’ve decided to Transfer this risk, but here are some pointers to help you as you work through the Identify / Categorise / Decide portion of assessing this risk:

– When you’re trying to Identify the impact of this risk occurring, it helps to have an idea of how much it costs you – as a family – to live your life each month.

o Naturally, the budgeting exercise outlined in our Manage volume will help you identify this.

– Once you’ve identified that figure, work out how much of that your household would be able to cover if your income stopped.

o This might include other incomes in the house, government benefits or other entitlements/payments.

– The gap between these two amounts is a great proxy measure for the ‘Impact’ of you losing your income.

– The next step is to multiply that by the number of years to get an idea of the bigger impact.

o For short-term issues (such as losing your job suddenly or having to leave your job for personal reasons), I suggest multiplying this gap by 6;

o For longer-but-not-permanent events (a serious, but treatable illness, prolonged parenting leave), I suggest calculating how much you’d need for two years, or 24 months;

o For permanent situations (a total and permanent disability), I’ve always used the number of years til you can access the Aged Pension as the benchmark.

So if you’re 45, your current pension age is 67 – so multiplying by 264 (22 years, by 12 months) will give you an indication of the impact*.

*For this calculation, we normally use a Present Value formula to determine the exact figure, but this proxy is fine for our purposes here.

Let’s Look At Louise

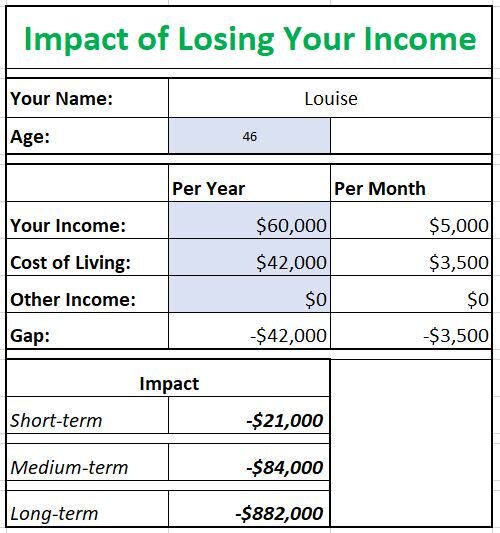

To put this into clearer context, let’s take Louise’s situation and enter the specifics into the Income Gap Calculator in the Risk Management Plan:

This way, we can see:

– Louise has 21 years until she might be able to access the Aged Pension. If we multiply that by the $42,000 shortfall that’ll arise if she lost the ability to earn an income, we can see that the impact on her future would be $882,000**.

– At the same time, a two-year illness and treatment programme would leave her exposed to an $84,000 gap in her budget, while she’s carrying a $21,000 exposure to something far less serious.

(**In reality, this figure might understate Louise’s exposure, depending on the likely inflation and return figures used in the more detailed Present Value calculation)

OK, So Now What?

This information is really useful for the Identify phase of the assessment process for Louise. And once defined, this information can help shape her decisions around the actions she’d like to take to protect herself from the potential impact of these risks.

And this is the real value in working through these risks in a methodical way. By now, you should feel comfortable:

1) Identifying these big risks and how they could impact your own life;

2) Thinking about the likelihood of these risks occurring;

3) Deciding – after balancing these two factors – how you might like to manage these risks.

In our next few posts we’ll outline the options you can choose from when it comes to managing these possibilities.

In the meantime – pat yourself on the back for investing the time and emotional energy in taking charge of such important parts of your financial life.

Not everybody does it.

But then, not everybody gets to choose the luxurious wheelchair either.