Welcome (back) to our Six Stones series. Our financial adviser, Jordan, is sharing as many tips, ideas and advice for people going through a divorce as a humble blog will allow.

He’s staying away from specific financial advice – it’s all general advice over here, be sure to get personal financial advice before doing anything – but we hope you find some useful information in here as you navigate through/out of your divorce.

In our last post, we talked about the degree of complexity that comes from the risk we perhaps all fear the most – death.

The reason I hopped down such a morbid rabbit hole was to try and demonstrate the real value that comes from preparing for the impact of the big risks in our life.

To try and outline what ‘preparation’ can look like when we’re talking about the consequences of your untimely death (and other happy matters), let’s bring Louise back.

Welcome Back, Louise.

I introduced Louise in Part One of our series. Here’s how I introduced her:

Louise is 46 and works as an office manager at a local law firm. Her and her ex separated two years ago and while it was tough telling their two kids, it was undoubtedly the right thing to do.

A few months down the track,. Louise comes in to talk about how things are progressing since we last spoke.

Louise is feeling a bit insecure since her divorce, and now that she has her budget humming along, she’d like to talk about how she can protect herself and the kids from life’s worst-case scenarios.

Owns and Owes

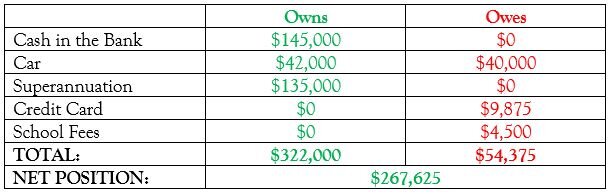

A piece of jargon you’ll probably see when you start working on your finances is the idea of your ‘balance sheet’.

I find it useful to just think of the balance sheet as what you own and what you owe.

In Louise’s case, after the property settlement, she owned and owed the following:

Green is good.

Which means, in simple terms, that Louise’s net wealth is $267,625 – a reasonably robust position to be in given what she’s been through.

Her Worries

But Louise is nervous that if something happened to her, there may not be enough money to provide for her kids.

Getting to know Louise a bit more, we’re able to get a clearer idea of just she wants to address if she were to pass away:

1) Looking After the Kids

Louise has two kids:

– Tim, 14, loves soccer a lot more than school, though with some persistence from both his parents he can knuckle down and get his work done;

– Lara, 12, is comparatively quiet, with a book in her back pocket just waiting to be opened any time. She loves English, is good at Maths and hates PE.

School

The kids went to a local, public, primary school, but as of next year both Tim and Lara will be at private schools in the neighbourhood.

Tim’s current school fees are around $12,000 a year, but when you take into account the school uniforms, sports clothes, soccer boots, extra-curriculars, voluntary levies, camps and everything else, it’s closer to $18,000.

Lara’s fees will be in the same bracket and Louise has assumed an annual fee of around $16,000, but $20,000 this year as they get all the uniforms, laptop, books and everything she’ll need.

Louise and David have agreed to split these fees down the middle and struck an agreement with the school to pay them off each month.

They’re not entirely clear on how they’ll be able to cover both sets of fees, but they committed to this course of action and want to continue prioritising their kid’s education.

If She Were Gone…

But if Louise weren’t here, she’s worried how these fees would be covered, and how the money to cover the everyday stuff would even come from.

She’d also like to pass something on to the kids if she passed away before she had bought a house – ‘an amount to help them get a good start in life.’

Their father will be able to look after them, and likely be able to leave them something, but Louise wants to make sure there’s something parked just for them to help them out when they get older.

2) The Debts

Louise is adamant that her debts – all of them, the credit card, the car loan, the school fees – have to die with her.

3) Her Ex-Husband’s Role

Then there’s David, Louise’s ex-husband.

Thankfully, their divorce wasn’t one of the nightmares you read about, with acrimony and rage on each side.

Simply – sadly – the marriage had just died over time and they decided to end it.

But in doing so, they were terribly aware of the impact that’d have on the kids and put them first every step of the way.

Louise knows that David is a great father and though their parenting arrangements have the kids at Louise’s house most weeknights, they make the ‘every second weekend and couple of weeknights’ structure work.

David works relatively long hours as a senior manager at a major consumer goods company, with monthly trips to Sydney and Brisbane, as well as at least one overseas trip each year.

His job doesn’t really have much in terms of flexibility with hours or workload, which was a big part of their choosing for Louise to have the kids more frequently during the week.

David’s also renting where he lives and hasn’t thought about where, when or how he might look to buy another place at this stage.

Louise worries that if she were to pass away, David would need to become the kid’s primary carer – a role that’s just not compatible with his career.

And given that his career is – for now, at least – underpinning their financial future, what would it mean if he had to stop working?

Put another way – so he would need to stop working, but what kind of impact would that big a financial change have on the life they’ve planned for their kids?

4) Her Mother

Louise’s father passed away around 15 years ago, and her 66-year old mother is still living in the family home.

She stopped working a few years ago and lives comfortably on the combination of her late husband’s government pension and the earnings from her superannuation.

However, Louise is increasingly aware of how inappropriate the home – with its two stories, the verandah her dad added on the back, and narrow bathrooms – is for an elderly person.

She knows that – at some stage – her mother will need to move to somewhere more suitable, either via downsizing to a smaller property or, eventually, to some sort of care facility.

Louise and her three siblings – two brothers, one sister – have talked about it in passing, but they’re all reluctant to bring it up with their mother.

She hasn’t said it, but Louise assumes she’ll probably end up taking the lead on caring for their mother and is worried what might happen to her if Louise wasn’t here.

5) Her Resources

Louise has ‘parked’ her share of the settlement in her bank account for now but knows that she will have to – at some stage – do something about the $145,000 sitting in her bank account.

At the same time, she’s acutely aware of just how expensive those few months after someone dies can be for the people left behind.

Between the funeral, ongoing bills, time away to grieve and all the many, many other costs, she’d hate to not leave anything behind to cover these big bills.

But she’s worried that either what she leaves won’t be enough – or she’ll have ‘locked’ too much of it away in an investment and her family won’t be able to access it when they need it.

These fears sit in the back of Louise’s mind, prodded back to life whenever she thinks about the horrible idea of not being here for her kids.

Thankfully, she’s taken the time to articulate them in detail, so she can fully recognise why they’re important, why they worry her and – inadvertently – some ways she might be able to deal with them.

It’s hard to overstate just how valuable this process of articulation is when it comes to quieting that voice in the back of your head. Talking through these issues – as with any risk you’re facing – draws a face on the monster.

And once it’s got a face, you can start looking it in the eye.